Fixed Rate Price Plans – Are there Risks?

30 Jul, 2018 7:40 PM / by Quek Leng Chuang

A fixed rate electricity plan is one where the consumer is charged a fixed tariff in $/KWh for a tenure of at least 12 months. It is most commonly touted as a risk-free plan which provides security and stability in your monthly spend for electricity. A plan that makes budgeting easy. Let’s challenge this narrative.

Whilst a fixed rate plan does have some advantages, it has many startling disadvantages not apparent to the average consumer.

Risks

Where are the risks in a fixed rate plan? The main risks come in when one ‘enters’ the electricity market and locks in a fixed rate for a tenure of 12/24 months.

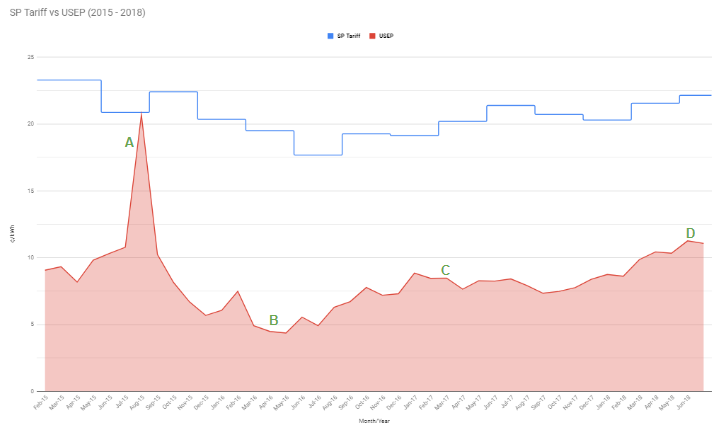

The chart above illustrates two significant tariffs in the electricity market from 2015 to mid-2018. The blue line is the Singapore Power Tariff that changes every 3 months, which represents the absolute price ceiling a consumer ought to purchase power. The shaded red is the Uniform Singapore Electricity Price (or USEP, which is the wholesale cost of electricity). The time horizon of 2015 onwards has been selected because no significant infrastructural change occurred since then, viz, after the launch of the EF (Electricity Futures) market in April 2015 and when LNG was adopted by over 95% of all power generating assets in Singapore.

With the clarity of hindsight, it is now easy to see that the optimal market entry point to fix your tariff was at point B. As fixed rates offered by any retailer significantly depend on the USEP, B is the best time to ‘enter’ the market and lock in a fixed rate because it is at historical low for the last 3 years. But, when we enter the market as consumers, we are not given a choice as fixed rates are thrust to us as at the point of transaction. And, currently, these fixed rates are offered at point D, where the market seems to be half way from the historical low to the historical high, on a slight ascend. Now, imagine purchasing a house. Would you enter the market without considering if it is at a high or at a low? We believe your answer is no. So why would you ‘enter’ the electricity market now (at point D) and lock yourself for 2 years?

So the inherent risk of taking up a fixed rate plan is that you probably do not know if at the moment of your transaction the market is at point A, B, C or D. Ask this to your retailer before you jump into a decision to lock yourself for 2 years.

The fallacy of fixed budget

Fixed rate tariffs do not automatically allow the consumer to form predictable budget for electricity expenses. Electricity expenses can be calculated by multiplying the tariff ($/KWh) by your usage (KWh). But the most significant parameter in this equation is the usage. This is what really determines the electricity expenses. The usage varies from one business type to another, rises and falls depending on operational activity. Some organizations have cyclical activity with high and low months (such as schools for instance) while manufacturing facilities drop and rise with production volume. Understanding your usage patterns and trends is a more accurate and predictive way to work out your electricity expense budget. And properly doing this allows you to budget your other operating expenses such as human resources, raw materials and the like.

The fallacy of security

Fixed rates do have the inherent attribute of security from sudden price hikes. But the same security can be obtained by placing ‘caps’ on your electricity tariff exposure. Since the advent of the EF market in 2015, large companies can trade directly to mitigate their exposure, whilst smaller companies can adopt similar mitigating strategies through their electricity retailer.

The EF market offers consumers (especially large enterprises) higher precision and finer tuning means in mitigating electricity exposure. By extension, a fixed rate plan has elements of obsolescence with a EF market already running for 3 years.

In closing, before you purchase a fixed rate plan, know that you have other options to achieve the same goals of budgeting and security. Work with a retailer that can add value, by providing you access to the EF market or hedging services. Take cognizance of the electricity market and ‘enter’ it with both eyes opened before locking in a fixed rate plan.

Topics: Environmental Offset

Written by Quek Leng Chuang

LengChuang is a chemical engineer and an expert in carbonomics. He is the founder and owner of Environmental Solutions (Asia) Pte Ltd.