Fuel Indexed Electricity Plans – NOT IN CONSUMER’S INTEREST

06 Sep, 2018 1:24 PM / by Quek Leng Chuang

Several retailers still offer a Fuel Indexed (FI) electricity price plan which propagate two broad value statements.

1. It’s good for businesses in the petrochemical, energy industry, or industries whose operating costs are tied to oil prices.

2. It allows businesses to increase operational production/output, when oil prices and by extension, electricity prices are cheaper.

These statements are not only vague, they are also very difficult to substantiate in the electricity market in 2018. After all, what business is not affected by the rise and fall oil & gas prices?

The FI priced plans constitutes a monthly variable tariff that is computed by an equation:

S$/MWh = A + B x ƒ(HSFO) x ƒ(USD/SGD)

The FI tariff consist of 2 components, Component “A” is af a fixed tariff. The inherent risks of “A” is the same risk as one would have when opting for a Fixed Rate Plan. When a buyer is unaware and largely ignorant if the prevailing tariffs are high or low when deciding to ‘enter’ the market and fix a price for a long tenure.

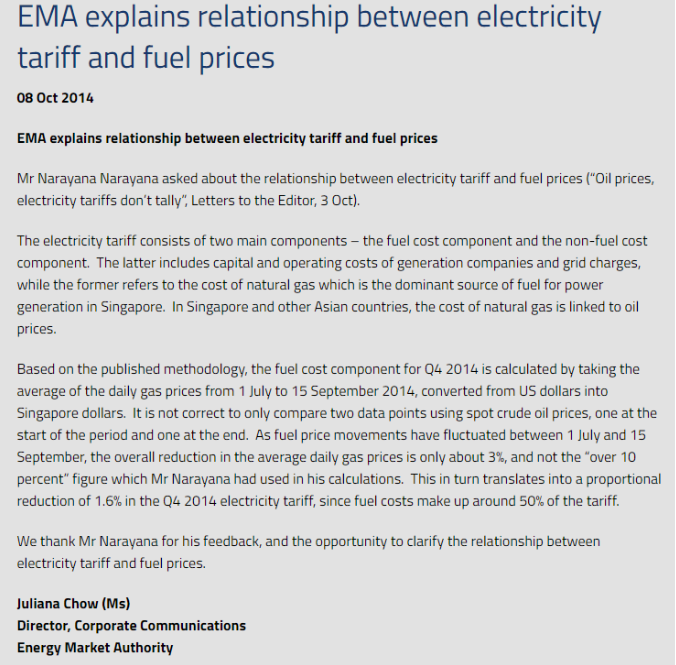

Component “B” is a function of the variability and fluctuation of both High Sulphur Fuel Oil (HSFO) prices and USD/SGD rates. The costs of fuel is only 50% of the total electricity tariff. EMA rationalised in 2014 (read below extract from EMA) that an over 10% of fluctuation in oil price, translated to a 3% movement in LNG price, which then translated to only a 1.6% movement in the electricity tariffs. Coupled with, that since 2015, 95% of all Singapore power generation is fueled by LNG and not HSFO, makes direct HSFO pricing very weakly linked to Electricity Tariffs.

HSFO prices, and USD/SGD exchange rates are 2 traditional financial risks to borne by Gencos (Power Generation Companies). Even post 2015, since LNG in is traded in USD. Gencos transfers these financial risks to adopters of FI price plans.

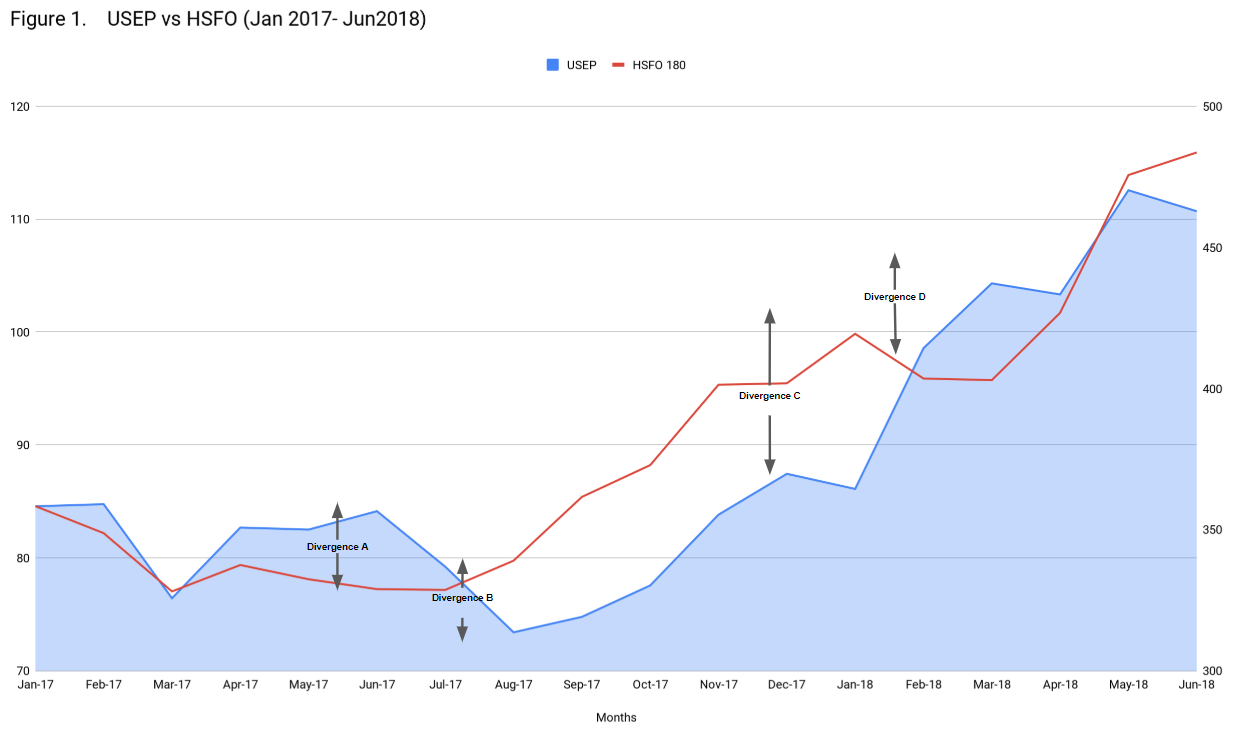

Evidence of (a lack of) Correlation

Referencing Figure 1. reveals another fundamental flaw for the FI price plans. Over January 2017 to June 2018, we have observed 4 apparent moments where huge divergence occurred in the oil prices and USEP. Firstly in Mar – Jul 2017, with the USEP prices rising, while the HSFO trended depressively. Then in Jul -Aug 2017 when USEP dived while HSFO price sprung up till Jan 2018.

Referencing Figure 2. reinforces their conclusion of a weak correlation between HSFO and Electricity tariffs in Singapore. Where divergence starts in Feb 2017, and continues for much of the period till Jun 2018.

FI Plans are Antiquated

The advent of the Electricity Futures (EF) market in April 2015, enable now for consumers to directly hedge electricity prices in SGD, thus eliminating all the potential currency exchange risks. Also eliminating the need for consumers to hedge risks by proxy of another commodity such as HSFO, LNG, and certainly not USD/SGD. Hedging by proxy increases and encumbers one with additional risks, which requires intense resources to focus on the market dynamics of these other proxy commodities. The EF market has made the FI price plan obsolete and irrelevant .

The FI price plans are fundamentally flawed and not designed in a way where it benefits the consumer. It is heavily linked to HSFO prices and USD/SGD. Gencos actually transfer this risk to consumers via the mechanism of a FI price plan. Gencos will still need to hedge in HSFO, USD/SGD but we as consumers have no real reason to.

The link between the electricity tariff and HSFO is weak and can sometimes trend in opposing directions because they are subject other mutually exclusive market dynamics. Finally the ability to hedge directly in the EF market, provides even the most complex consumer the effective means to accurately manage his electricity price plans’ risks.

If you wish to have more information about the diverse electricity plans and ES Power’s offers, get in touch with us via email at gogreen@espower.com.sg or call 1800 888 1010.

Topics: Carbon Neutrality, Environmental Offset

Written by Quek Leng Chuang

LengChuang is a chemical engineer and an expert in carbonomics. He is the founder and owner of Environmental Solutions (Asia) Pte Ltd.